From Mobile to Desktop: Mapping Online Casino Device Preferences Worldwide

Overview

As the online casino industry continues to expand rapidly in both reach and complexity, understanding regional device preferences has become a strategic necessity. Whether players prefer mobile, desktop, or tablet varies widely across markets, and these trends can directly affect your user acquisition, retention, and monetization strategies.

In this article, we take a closer look at device usage trends across major global iGaming markets. We’ll also share practical insights to help platform operators refine their user experience, campaign execution, and product strategy to meet player expectations in every region.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Agreegain does not accept any liability for its use.

Global Snapshot: Mobile Leads, But Not Everywhere

In 2023, mobile devices made up 87% of the global online gambling market, highlighting the dominance of mobile gaming worldwide. Still, this global figure masks significant regional differences when you zoom in on individual markets.

While mobile-first design is crucial in many regions, there are still areas where desktop and tablet use dominate online casino activity. These local preferences are usually shaped by factors such as economic development, infrastructure, user behavior, and regulation.

Why Device Preference Matters for Platform Providers

Knowing which devices players use goes beyond user experience—it should be a core strategic consideration for every online casino platform provider.

Device preferences shape the entire player journey: how they access and interact with games, and which engagement tools are most effective.

- Mobile Players: Usually engage in shorter, more frequent sessions. This requires ultra-fast load times, streamlined navigation, and thumb-friendly design.

- Desktop Players: Tend to enjoy longer, more immersive sessions, particularly for live dealer games, tournaments, and high-stakes play. They expect advanced features such as multi-window gameplay, deeper analytics, and desktop-optimized loyalty programs.

Device choice also affects onboarding and payments. KYC flows must be intuitive on every platform:

- On Mobile: This means quick photo ID uploads and biometric login options.

- On Desktop: It’s about clarity and trust—presenting all required documentation in a single, scrollable view.

Customer support should also be tailored to the device:

- Mobile-First Markets: Players often prefer live chat or WhatsApp-based support.

- Desktop Users: Typically lean toward on-site FAQs or email assistance.

For platform providers, aligning product delivery with device preferences in each target market isn’t just best practice—it’s a powerful competitive advantage.

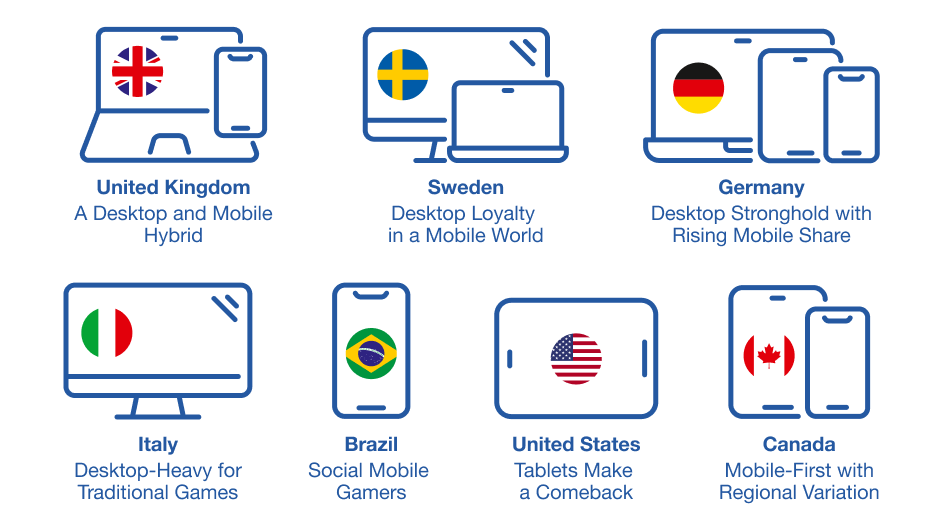

A Country-by-Country Breakdown of Device Preferences

In this section, we’ll explore player device preferences for online casino activity, country by country. This helps paint a clearer picture of where mobile dominates, where desktop still holds strong, and where multi-device strategies are essential.

United Kingdom: A Desktop and Mobile Mix

- Device Preferences: Mobile (58%), Desktop (38%), Tablet (4%)

- Why: The UK has widespread high-speed broadband and a long tradition of home PC use. Many players still enjoy immersive casino gameplay on larger screens, especially for poker and live dealer games.

- Operator Tips: Make sure your platform enables seamless desktop-to-mobile transitions for uninterrupted play. Keep in mind that desktop UX is still highly relevant in the UK market and shouldn’t be overlooked.

Sweden: Desktop Loyalty in a Mobile-First World

- Device Preferences: Desktop (45–50%), Mobile (45%), Tablet (5–10%)

- Why: Nordic players are tech-savvy but cautious, often favoring the security and stability of desktop, particularly for high-stakes play and strategic games.

- Operator Tips: Provide advanced features and analytics on desktop to align with the analytical mindset of local players. Offer account syncing across devices for smooth continuity when players switch mid-session.

Germany: A Desktop Stronghold with Growing Mobile Adoption

- Device Preferences: Desktop (50%), Mobile (45%), Tablet (5%)

- Why: German players tend to be cautious and prefer the perceived security of desktops when handling deposits and withdrawals at online casinos.

- Operator Tips: Optimize your desktop UX for clarity and compliance. Consider offering downloadable desktop clients or exclusive desktop features to reinforce local preferences.

Italy: Desktop-Heavy for Classic Games

- Device Preferences: Desktop (55%), Mobile (40%), Tablet (5%)

- Why: Italian players remain loyal to traditional online casino formats and often prefer desktops for classic games like poker and roulette.

- Operator Tips: Deliver a traditional casino atmosphere on desktop and prioritize licensed Italian-language content. Strict adherence to Italy’s advertising regulations is critical.

Brazil: Social Mobile Gamers

- Device Preferences: Mobile (85%), Desktop (12%), Tablet (3%)

- Why: The combination of widespread smartphone adoption and a social-first culture makes mobile the default for digital entertainment.

- Operator Tips: Leverage mobile tournaments, social slots, and WhatsApp-based support to boost engagement and build brand loyalty.

United States: Tablets Make a Comeback

- Device Preferences: Mobile (60%), Desktop (30%), Tablet (10%)

- Why: Mobile ownership is high across demographics. As the birthplace of the iPad, the U.S. is seeing tablet usage rise, especially among older players in states where online gambling is now legalized.

- Operator Tips: Don’t underestimate tablet UX and design. Cater to Boomers and Gen X players who gravitate toward larger screens and prefer slower-paced play.

Canada: Mobile-First with Regional Nuance

- Device Preferences: Mobile (70%), Desktop (25%), Tablet (5%)

- Why: Overall, mobile dominates, especially among younger players. However, desktop usage remains significant in more conservative provinces and with older demographics.

- Operator Tips: Focus on mobile UX and ensure geolocation accuracy to comply with regulated provinces. At the same time, recognize the importance of the growing Boomer market that favors desktop play.

Mastering Device Type UX and Platform Optimization

Each device type comes with its own online casino user experience (UX) constraints and opportunities. Adapting your platform accordingly is essential for maximizing player engagement, retention, and long-term value.

Here are device-specific approaches to achieve this:

- Mobile: Prioritize vertical-first design, simplified interfaces, and fast load times. Mobile players expect intuitive navigation, quick access to key features like balances, bonuses, and deposits, as well as mobile-native functions such as push notifications and biometric login.

- Desktop: Optimize for longer sessions and more complex gameplay. Offer downloadable clients or responsive web versions with added features like advanced game filters, session history, and real-time analytics. Desktop remains the channel of choice for strategic players and VIPs, so the interface should deliver a more immersive casino environment.

- Tablet: Often overlooked, tablets are gaining popularity among older demographics and casual players who enjoy larger screens but avoid desktops. Optimize for both portrait and landscape modes, use larger CTAs, and ensure smooth touch interactions. Simplified navigation and educational prompts can boost retention among less tech-savvy users.

Across all devices, session syncing and cross-device logins are essential. Players increasingly expect to start a casino game on one device and seamlessly continue on another. For this reason, cloud-based profiles and progress tracking should be implemented as standard.

Platform providers that excel at multi-device optimization can significantly improve user satisfaction, reduce churn, and unlock higher lifetime value (LTV).

Monetization Strategies Tailored to Device Use

Device preferences also shape how, when, and why players spend on your online casino platform. Matching monetization tactics to device usage is a smart way to boost both average revenue per user (ARPU) and LTV.

Here’s how this plays out by device type:

Mobile Players: Well-suited to time-sensitive offers and microtransactions. Because mobile gameplay often happens in short bursts throughout the day, incentives like daily spin bonuses, streak rewards, and limited-time jackpots perform well. Gamified progress bars and push notifications also encourage repeat visits.

Desktop Players: Tend to engage for longer sessions and are more likely to explore high-stakes games or advanced features. They are prime candidates for upselling through loyalty programs, VIP tournaments, or real-money rewards tied to extended play. Since they also interact more frequently with support and account management tools, these users often convert to higher tiers over time.

Tablet Users: Popular among Boomers and Gen X players who respond best to clarity, simplicity, and trust-building offers. Slower-paced games, transparent bonus terms, and visually engaging interfaces are especially effective. Consider tailored offers that emphasize entertainment value rather than urgency.

By aligning monetization techniques with device usage patterns, platform providers can strengthen both short-term conversions and long-term retention.

Final Thoughts: Devices as Strategic Differentiators

As the country-by-country breakdown shows, device preferences are more than just a UX concern, they provide key strategic insights. This information can guide every part of your platform delivery and long-term strategy.

Device choices influence how players engage, how long they stay, and how often they return. From product design and payment flows to marketing campaigns and localization, understanding how and where players access your online casino can make all the difference.

While mobile is the global frontrunner, regional differences remain critical. In desktop-heavy markets like Germany and Sweden, neglecting non-mobile users could mean lost revenue. Meanwhile, in mobile-first nations like Brazil or Spain, even small points of friction in the mobile experience can hurt conversions and lifetime value.

In short, a one-size-fits-all strategy doesn’t work in most iGaming markets. To build a truly global online casino brand, operators must stay as adaptable as their players, fine-tuning the platform experience to match screen size in every region.