Generational Design: What Different Age Groups Really Want From Online Casinos

Overview

The global online gambling market reached $93 billion in 2024 and is projected to grow by 7 to 11% annually through 2030. But while the market continues to expand, many operators are still taking a one-size-fits-all approach to their game offerings and user experience.

This approach often leads to missed opportunities. Online casino providers that embrace customer segmentation typically see up to 15% higher revenue along with a 20% reduction in acquisition costs.

Tailoring your strategy to generational gaming preferences can help capture more market share, increase player retention, and optimize marketing spend. This article explores the preferences of each generational segment and how to turn these insights into a competitive advantage.

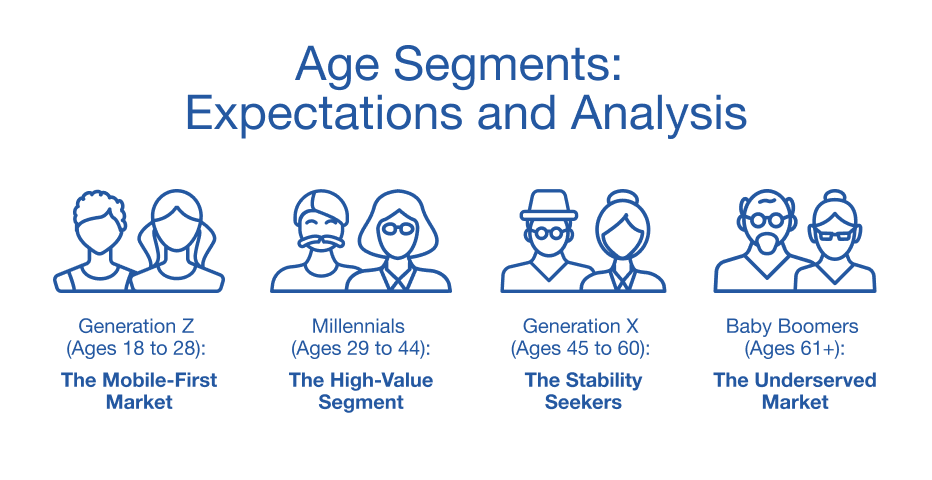

Age Segments: Expectations and Analysis

The data makes it clear: adapting to generational preferences isn’t just good for the user experience—it’s a smart business move.

Each generation brings unique playing and spending habits, shaped by the technology they grew up with. Let’s take a closer look at the traits of each group, starting with the youngest.

Generation Z (Ages 18 to 28): The Mobile-First Market

Why It Matters: Gen Z is the fastest-growing segment of online casino players. They’re digital natives with heavy mobile usage and a strong preference for fast, social, and transparent gameplay.

What They Like to Play:

- Live dealer games with high-quality streaming

- Gamified slots with levels, achievements, and storylines

- Social tournaments that tap into competitive gaming

- Crash games and provably fair titles they can trust

How They Spend:

- Prefer microtransactions over large deposits

- Play frequently, but in shorter sessions

Platform Essentials:

- Mobile-first design is non-negotiable

- Add social features, fast load times, and Twitch-style integrations

Millennials (Ages 29 to 44): The High-Value Segment

Why It Matters: Millennials are in their prime earning years and are willing to spend more for quality. They deliver the highest lifetime value.

What They Like to Play:

- Branded slots based on pop culture (’80s/’90s/2000s)

- Skill-based games that involve strategy

- Poker tournaments and competitive multiplayer formats

- Progressive jackpots that create community excitement

How They Spend:

- Focus on quality over quantity

- Willing to pay more for great graphics, exclusivity, and innovation

Platform Essentials:

- Seamless experience across mobile, tablet, and desktop

- Strong loyalty programs with tiers and meaningful rewards

Generation X (Ages 45 to 60): The Stability Seekers

Why It Matters: This group represents your most consistent and loyal online casino players. They spend regularly and stick around, making them low risk but highly reliable.

What They Like to Play:

- Classic table games with clean, modern visuals

- Traditional slots with a polished design

- Video poker with multi-hand options

- Bingo and community games with light social interaction

How They Spend:

- Prefer predictable sessions over high-risk thrills

- Enjoy steady, low-volatility gameplay

Platform Essentials:

- Easy-to-use interface with clear menus

- Reliable, human customer support

Baby Boomers (Ages 61+): The Underserved Market

Why It Matters: Boomers are online more than ever, and they have both the time and money to spend. Yet many platforms overlook their needs, making this segment largely underserved.

What They Like to Play:

- Simple slots with classic themes (e.g., fruits, 7s)

- Keno and lottery-style games

- Card games with clear rules and large buttons

- Low-volatility games that offer frequent wins

How They Spend:

- Focus on value and trust

- Respond well to VIP programs and personalized rewards

Platform Essentials:

- Accessible design with large text and simple layouts

- Multiple support options, including phone-based support

Turning Insights Into Action

Now that we’ve explored the typical online casino preferences and expectations of each generational segment, it’s time to adapt your offerings and strategies accordingly.

Here’s how to apply segmentation for each group across the game portfolio, promotions, user experience (UX), and marketing.

Generation Z (Ages 18 to 28): Personalize for Playfulness

Game Strategy:

- Highlight crash games, social slots, and multiplayer formats on mobile homepages

- Experiment with gamified missions, XP systems, and unlockable rewards

Promotional Tactics:

- Offer limited-time achievements, event-driven tournaments, and shareable milestones

- Create opt-in micro-purchase bundles that fit their smaller-spending style

UX Tips:

- Prioritize speed, intuitive navigation, and gesture-based design

- Add social features like leaderboards, emojis, and live chat

Marketing Channels:

- Focus on short-form video through platforms like TikTok or Instagram Reels (where permitted)

- Leverage influencer-led campaigns and live-streaming partnerships

Millennials (Ages 29 to 44): Promote Quality and Exclusivity

Game Strategy:

- Rotate branded content and pop culture–themed slots

- Showcase strategy-driven and skill-based games

Promotional Tactics:

- Offer exclusive early access or premium-tier content

- Use email and app notifications to deliver milestone-based bonus rewards

UX Tips:

- Provide a seamless experience across desktop, tablet, and mobile devices

- Offer personal dashboards with progress tracking and rewards

Marketing Channels:

- Leverage email, YouTube, and platform blogs

- Use nostalgia-driven visuals and targeted push notifications

Generation X (Ages 45 to 60): Streamline, Then Surprise Them

Game Strategy:

- Offer curated bundles of classic slots and table games

- Promote steady-return games (96%+ RTP) with occasional high-reward options

Promotional Tactics:

- Focus on reliable, easy-to-understand loyalty programs

- Offer time-based bonuses, such as rewards for playing three days within a week

UX Tips:

- Simple, straightforward layout with high contrast and minimal clutter

- Provide quick access to FAQs and live customer support

Marketing Channels:

- Use email newsletters, in-platform messages, and social media groups

- Add referral incentives to encourage sharing among trusted friend groups

Baby Boomers (Ages 61+): Support Simplicity and Trust

Game Strategy:

- Highlight familiar slot styles, plus bingo and lottery games

- Minimize novelty and emphasize ease of play, comfort, and familiarity

Promotional Tactics:

- Offer personalized rewards, birthday bonuses, and VIP tiers

- Focus less on gamification and more on reliability and recognition for returning players

UX Tips:

- Use large text, clean navigation, and reduced cognitive load

- Provide prominent “Help” buttons and call center contact options to build trust

Marketing Channels:

- Use email and phone outreach, both trusted by this demographic

- Include offline-style perks such as printed welcome packs by mail

Data and Analytics: Measuring Generational Impact

Designing for generational preferences is only the beginning. To truly optimize age-segmented strategies, you need to measure what works and what doesn’t, then iterate to improve key metrics:

Key Metrics to Track by Age Group

- Player Lifetime Value (LTV): Compare LTV across generations to identify your most profitable segments

- Session Length and Frequency: Track how long and how often players in each group engage with your platform

- Churn Rates: A spike in churn within a particular age group may indicate a UX mismatch or promotional fatigue

- Game Preferences: Use analytics to see which age groups gravitate toward specific genres or RTP ranges

Testing Implementation Tips

- A/B Test Promotions and Layouts: Test two different UX journeys or bonus campaigns with segmented audiences

- Segment CRM Data: Create dynamic player segments based on age and behavioral data for personalized outreach

- Feedback Loops: Use in-app surveys, reviews, or focus groups to validate assumptions and gather first-party insights

Tracking this data lets you fine-tune your platform to what each generation responds to best, backed by real-world numbers.

Compliance Considerations by Age Group

Age segmentation isn’t only about player preferences-it can also help manage regulatory obligations, especially around marketing, data handling, and accessibility.

Each generation interacts with platforms differently and may be protected by distinct sets of legal or ethical considerations, including:

Compliance Considerations for Gen Z (Ages 18 to 28)

- Always verify player age rigorously, since the minimum legal gambling age varies by jurisdiction

- In some markets, 18- to 21-year-olds face additional restrictions or marketing limitations

- Be cautious with influencer campaigns or social-style marketing aimed at this group—many regulators now closely monitor these channels

- Avoid imagery or language that could appeal to underage audiences, such as cartoon characters

Compliance Considerations for Millennials and Gen X (Ages 29 to 60)

- Be fully transparent in bonus offers and promotional terms, since these groups value fairness and clarity

- Avoid burying critical information in fine print, as unclear promotions can trigger regulatory penalties and erode player trust

- Be mindful of data privacy and personalization. These players are highly aware of their rights under GDPR and similar laws. Make opt-ins and data-use policies absolutely clear

- Ensure self-exclusion tools, deposit limits, and responsible gambling features are easy to find and simple to use

Compliance Considerations for Boomers (Ages 61+)

- Ensure accessibility features comply with recognized standards such as WCAG 2.1 (Web Content Accessibility Guidelines) to support inclusivity

- If your platform isn’t accessible, you may face legal action or regulatory scrutiny for discriminating against users with disabilities

- Provide alternative support channels, such as phone or live agent assistance, instead of assuming digital-only tools are sufficient

- Be especially careful with autoplay functions and game speed settings, as these may unintentionally disadvantage older users

Final Thoughts: The Future of Age-Segmented Casino Experiences

The era of one-size-fits-all casino platforms is over. Today’s most successful online casino brands recognize and embrace the subtle differences in generational behavior, delivering tailored experiences for every segment—from mobile-native Gen Z players to loyal but often overlooked Baby Boomers.

By applying age segmentation across game portfolios, promotions, user experience, and marketing, operators can achieve smarter acquisition, stronger retention, and higher lifetime value (LTV) per player.

The goal isn’t just to know your players’ ages—it’s to understand how age shapes their expectations and behaviors, and then turn those insights into action.