From Mobile to Desktop: Mapping Online Casino Device Preferences Worldwide

Overview

As the online casino sector continues to grow rapidly in terms of reach and complexity, understanding regional device preferences is a strategic necessity. Whether players favour mobile, desktop, or tablet varies significantly from one market to the next, and these trends can directly impact your user acquisition, retention, and monetisation strategies.

In this article, we examine device usage trends across leading global iGaming markets. We’ll offer some practical insights to help platform operators fine-tune their user experience, campaign delivery, and product strategy to match player expectations in any territory.

DISCLAIMER

This information is not intended to be legal advice and is solely extracted from open sources. It should not be relied upon as a substitute for professional legal advice, and Agreegain does not accept any liability for its use.

Global Snapshot: Mobile Dominates, But Not Everywhere

In 2023, mobile devices accounted for 87% of the global online gambling market, underscoring the dominance of mobile gaming worldwide. However, this global trend conceals plenty of regional variations when you drill down into specific markets.

While mobile-first design is essential in many regions, there are still some areas where desktop and tablet usage dominate online casino behaviour. These local preferences are typically influenced by economic development, infrastructure, user behaviour, and regulation.

Why Device Preference Matters for Platform Providers

Understanding which devices players use is more than a UX consideration, it should be a key strategic factor for any online casino platform provider.

Device preferences influence the structure of player journeys, how they consume games, and which engagement tools are most effective in reaching them.

- Mobile Players: Typically engage in shorter, more frequent sessions. This requires lightning-fast load times, simplified navigation, and thumb-friendly design.

- Desktop Players: Often enjoy longer, more immersive sessions, especially for live dealer games, tournaments, and high-stakes play. They expect advanced features like multi-window gameplay, deeper analytics, and desktop-optimised loyalty schemes.

Device type also affects onboarding and payments. KYC flows must be intuitive across all platforms:

- On Mobile: This means quick photo ID uploads and biometric login options.

- On Desktop: It’s about clarity and trust, presenting all required documentation steps in a single scrollable view.

Even customer support needs to be flexible based on the device:

- Mobile-first Markets: Respond better to live chat and WhatsApp-based help.

- Desktop Users: Often prefer on-platform FAQs or email assistance.

For platform providers, aligning product delivery with device preferences in each target market isn’t just good practice, it’s a major competitive edge.

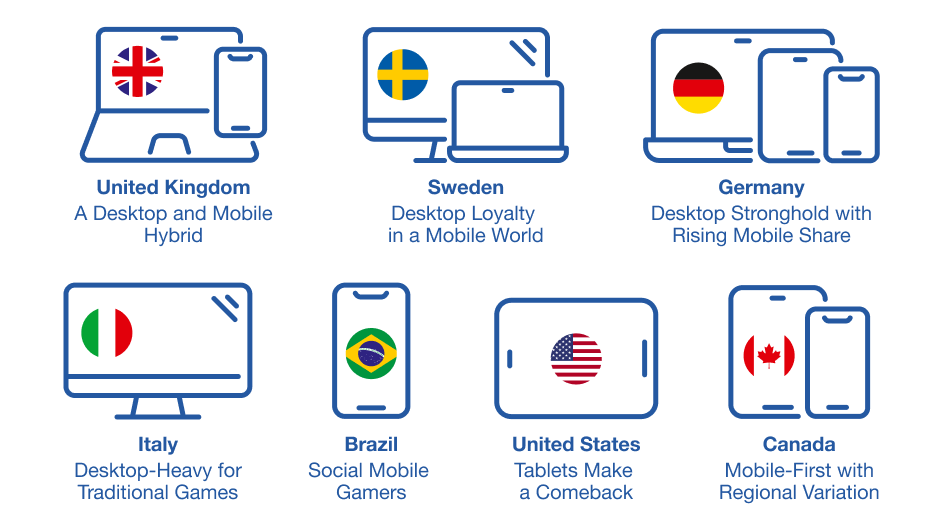

A Country-by-Country Breakdown of Device Preferences

In this section, we’ll break down player device preferences for online casino activity, country by country. This will give us a clearer picture of where mobile dominates, where desktop still holds strong, and where multi-device strategies are a must-have.

United Kingdom: A Desktop and Mobile Hybrid

- Device Preferences: Mobile (58%), Desktop (38%), Tablet (4%)

- Why: The UK has high-speed broadband and a strong tradition of home PC use. Many players still enjoy immersive casino gameplay on larger screens, especially when it comes to poker and live dealer games.

- Operator Tips: Ensure that your platform allows seamless desktop-to-mobile transitions for an effortless continuation of play. Be aware that desktop UX still matters in the UK market and should not be overlooked.

Sweden: Desktop Loyalty in a Mobile World

- Device Preferences: Desktop (45-50%), Mobile (45%), Tablet (5-10%)

- Why: Nordic players are tech-savvy but cautious and prefer the security and stability of desktop, especially for high-stakes play and strategic games.

- Operator Tips: Provide advanced features and analytics on desktop to suit the analytical nature of local players. Offer account syncing across devices for session continuity if players switch how they play during a session.

Germany: Desktop Stronghold with Rising Mobile Share

- Device Preferences: Desktop (50%), Mobile (45%), Tablet (5%)

- Why: German users are typically cautious and prefer the perceived security of desktops when making deposits and withdrawals at online casinos.

- Operator Tips: Optimise your desktop UX for clarity and compliance. Offer downloadable desktop clients or desktop-exclusive features to reward local preferences.

Italy: Desktop-Heavy for Traditional Games

- Device Preferences: Desktop (55%), Mobile (40%), Tablet (5%)

- Why: Italian players show loyalty to traditional online casino formats and often prefer desktops for games like poker and roulette.

- Operator Tips: Deliver a classic casino feel on desktop and focus on licensed Italian language content. Compliance with Italy’s strict advertising rules is essential.

Brazil: Social Mobile Gamers

- Device Preferences: Mobile (85%), Desktop (12%), Tablet (3%)

- Why: Widespread smartphone adoption across the country, paired with a social-first culture, means that mobile is now the local norm for all digital entertainment.

- Operator Tips: Utilise mobile tournaments, social slots, and WhatsApp-integrated support to increase engagement and build local brand loyalty.

United States: Tablets Make a Comeback

- Device Preferences: Mobile (60%), Desktop (30%), Tablet (10%)

- Why: Mobile device ownership is high across the board. As the home of the iPad, tablet use is rapidly growing among older demographics, especially in states where online gambling is now legalised.

- Operator Tips: Don’t overlook tablet UX and design to appeal to Boomers and Gen X players who are more comfortable with larger screens and slower-paced play.

Canada: Mobile-First with Regional Variation

- Device Preferences: Mobile (70%), Desktop (25%), Tablet (5%)

- Why: As a general rule, mobile dominates, especially among younger players. That said, desktop usage persists in more conservative provinces and among the older demographic.

- Operator Tips: Prioritise mobile UX and geolocation accuracy to tailor experiences for regulated provinces. Don’t overlook the growing Boomer market that prefers a desktop online casino experience.

Mastering Device Type UX and Platform Optimisation

Every device type has its own online casino user experience (UX) constraints and opportunities. Tailoring your platform to adapt accordingly is essential for maximising player engagement, retention and longer-term value.

Here are per-device approaches to achieve this:

- Mobile: Prioritise vertical-first design, simplified interfaces, and fast loading speeds. Mobile players expect intuitive navigation, quick access to key features like balance, bonuses, and deposits, and mobile-native functions like push notifications and biometric login.

- Desktop: Optimise for longer session durations and more complex gameplay. Offer downloadable clients or responsive web versions with additional features such as advanced game filters, session history, and real-time analytics. Desktop is the preferred channel for strategic players and VIPs, so the interface should reflect a more immersive casino environment.

- Tablet: Often overlooked, tablets are increasing in popularity among older demographics and casual players who value larger screens but dislike using desktops. Optimise for both portrait and landscape modes, use larger CTAs, and ensure touch interactions are always smooth. Simplified navigation and educational prompts can increase retention among less tech-savvy users.

Across all devices, session syncing and cross-device unified logins are essential. Players increasingly expect to start a casino game on one device and seamlessly continue it on another. For this reason, cloud-based profiles and progress tracking should be implemented as a standard feature.

Platform providers that master multi-device optimisation can greatly improve user satisfaction, reduce player churn and unlock higher lifetime value (LTV).

Monetisation Strategies Tailored to Device Use

Device preferences can also shape how, when, and why players spend on your online casino platform. Matching monetisation tactics to device usage is a smart tactic to boost both average revenue per user (ARPU) and LTV.

Here’s how this can work for each device type:

Mobile Players: Well placed to receive time-sensitive offers and microtransactions. Because mobile gameplay is often fragmented throughout the day, incentives like daily spin bonuses, streak rewards, or limited-time jackpots work well. Gamified progress bars and push notification nudges also drive repeat visits.

Desktop Players: Tend to engage for longer periods and are more likely to explore high-stakes games or deep features. This makes them prime targets for upselling via loyalty programs, VIP tournaments, or real-money rewards tied to extended play. Because they're also more likely to interact with support and account management tools, these users often convert to higher tiers over time.

Tablet Users: Popular with Boomers or Gen X players who respond well to clarity, simplicity, and trust-building offers. Slower-paced games, transparent bonus terms, and visually engaging interfaces make a big difference. Consider custom offers for this segment that focus on entertainment rather than urgency.

By aligning monetisation techniques with device usage patterns, platform providers can improve both short-term conversions and long-term player retention.

Final Thoughts: Devices as Strategic Differentiators

As the above country-by-country snapshots reveal, player device preferences are more than just a UX consideration, they also offer us some vital strategic insights. This information can help guide every part of your platform delivery and future strategy.

Device preferences shape how players engage, how long they stay, and how often they return. From product design and payment flows to marketing campaigns and localisation, knowing how and where your players access your online casino can make all the difference.

While mobile is now the global frontrunner, regional nuances still matter. In desktop-strong markets like Germany and Sweden, ignoring non-mobile users could mean leaving revenue on the table. Equally, in mobile-first nations like Brazil or Spain, any friction in the mobile experience could hurt conversions and player lifetime value.

To sum up, a one-size-fits-all strategy won’t fly in most iGaming territories. To build a truly global online casino brand, operators must be as adaptable as their players, fine-tuning the platform experience to suit the screen size in every market.